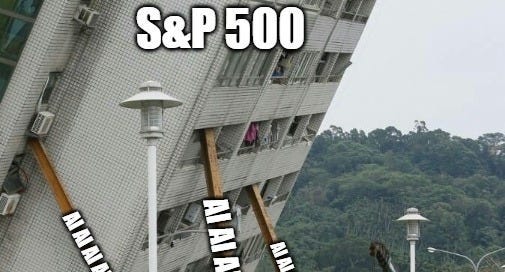

A Decade of Discontent? Goldman Sachs Throws Shade (and Numbers) at the S&P 500's Future

Hold onto your hats, investors, because Goldman Sachs dropped a report in October that's colder than a polar bear's nose!

Podcast version for premium subscribers available HERE

Their analysts are predicting a serious slowdown for the S&P 500, forecasting an average annual nominal return of just 3%over the next decade. To put that in perspective, the index has been cruising along at a cool 13% average annual return for the past 10 years. Talk about a market mood swing! It's enough to make you want to sell all your stocks and invest in a lifetime supply of ramen noodles (though I wouldn't recommend that, unless you really like ramen).

Why So Glum, Chum? Decoding the Doom and Gloom

So, why is Goldman Sachs suddenly channeling their inner Eeyore? Well, they seem to think the market is currently more overvalued than a beanie baby collection in 2024. (Okay, maybe not that bad, but you get the idea.) Their fancy statistical model, which factors in everything but the kitchen sink, suggests we're headed for a period of "meh" returns.

Here's a peek at the variables swirling around in their crystal ball:

Starting Valuations: Remember that time you bought a houseplant for $10 and then saw it selling for $50 the next week? Yeah, that's kind of what they're saying about the market right now. High starting valuations usually mean less room for growth.

Market Concentration: It's like the market is a basketball team where only a few players score all the points. Currently, 10 companies represent over 36% of the S&P 500's total value. Goldman Sachs warns that this concentration could lead to increased volatility and risk. (Translation: more ups and downs than a rollercoaster ride.)

Frequency of Economic Contractions: Nobody likes a recession, and Goldman Sachs predicts we'll have about 4 quarters of recession over the next 10 years. (Don't worry, that still leaves 36 quarters for margaritas on the beach!)

Interest Rates: Remember those things called bonds? Well, rising interest rates can make them more appealing than stocks, potentially leading to a mass exodus of investors. (It's like everyone suddenly deciding to go to that new taco place across town instead of your favorite burger joint.)

Corporate Profitability: If companies aren't making money, their stock prices are likely to take a hit. (It's basic economics, folks. Or, as my grandma used to say, "You can't make an omelet without cracking a few eggs... or having any chickens.")

Adding Insult to Injury: Bonds and Inflation Join the Party

To make matters even more interesting, Goldman Sachs says there's a 72% chance the S&P 500 will underperform bonds over the next decade. And wait, there's more! There's also a 33% chance it won't even keep up with inflation. (So, you might end up with a bigger number in your investment account, but it'll buy you less stuff. Kind of like how a bag of chips seems to get smaller every year.)

But Wait, Lets have a Look at Earnings and Valuations

Let's rewind the clock and take a closer look at the numbers behind the S&P 500. Ten years ago, the earnings per share (EPS) for the index was $115. Today, it's sitting pretty at $196. That's a solid increase, no doubt. But what's the compound annual growth rate (CAGR)? Time for some number crunching:

Keep reading with a 7-day free trial

Subscribe to Waver to keep reading this post and get 7 days of free access to the full post archives.